Small business and big business both have finance in common

Power your business with smarter finance

Need capital for growth, equipment, or a commercial property? Whether you’re a sole trader or scaling a team, Mas Que Finance delivers solutions that work for real businesses, not just ideal credit profiles. Let’s find the right mix of flexibility, speed, and strategy.

Need to build? Sick of renting? Takes money to make money? Whatever your reason let’s talk about your big business ideas to get you the funding you need.

Built for business owners

🏭 Commercial Property Loans

From office spaces to warehouses, we’ll help you secure the right loan to purchase or refinance commercial assets.

🔄 Equipment & Fit-Out Finance

Set your business up for success with lending for vehicles, machinery, or that new shopfront without draining your cash flow.

📈 Cash Flow Lending

Unsecured options and invoice finance available for working capital, marketing, or expansion, fast and flexible.

👔 Self-Employed Friendly

We get that your tax return doesn’t always tell the whole story. We'll explore full doc, alt doc and low doc options that suit the way you actually earn.

🎯 Client Wins.

Every business needs some form of finance to help grow. It takes money to make it and we’ve helped our clients close in on their dreams. Help start a business, help become the landlord or improve cashflow.

🏢 Business Owner, Big Move

Client: Self-employed tradie looking to purchase their first warehouse

Challenge: Great income but no recent tax returns on file — and needed to move quickly on a warehouse opportunity before someone else snapped it up

Solution: We used a lease doc loan which allowed the client to borrow based on rental income from their existing premises and a lease agreement on the new site

Outcome: Purchased the commercial space with no fuss, avoided delays, and didn’t need to pause business to gather endless paperwork

Why it worked: We know which lenders are flexible with self-employed income, and we knew how to structure it from day one

Key Takeaways:

✅ No tax returns needed with lease doc

✅ Fast turnaround for time-sensitive deals

✅ Ideal for self-employed and growing businesses

Stress-Free Upgrade

Client: Small business owner who had a commercial property loan with a big bank

Challenge: Annual reviews, constant requests for financials, and short loan terms were draining time and energy

Solution: We refinanced to a lender offering a full 30-year term, no annual reviews, and a much simpler ongoing process

Outcome: Freed up time and mental space to focus on growing the business plus, locked in a much more manageable monthly repayment

Why it worked: We knew the lenders that play long-term, not short-term pressure games

Key Takeaways:

✅ No more annual reviews or requalifying headaches

✅ Long-term stability with a 30-year term

✅ More time to focus on your business, not your bank

🏀 Funding a Sports Shop Franchise

Client: Young couple opening their first sports retail franchise in a busy shopping strip

Challenge: No previous retail experience, startup phase with no trading history, and needed capital for fit-out, stock, and franchise fees

Solution: We worked with a lender who supports new franchise operators. Leveraged the strength of the franchise brand, the couple’s home equity, and a solid business plan. Fit-out and initial stock were financed via lease-doc and unsecured funding mix.

Outcome: Store was funded, fit-out finished on time, and they opened with full shelves. They’ve since expanded into online sales with strong community support.

Why it worked: We knew how to present their case beyond just numbers showing lender confidence through planning, franchise backing, and their commitment.

Key Takeaways:

✅ You don’t need years of trading to get started

✅ Franchises can be strong leverage points with lenders

✅ Home equity can be a powerful launchpad

✅ We structure startup finance to match your goals — not just tick boxes

We win when you win. Starting your business? Are you already established and looking for your next move? Lets start making your goal a reality

How It Works.

1. Let’s Chat

📞 Book a quick call so we can get to know you and your goals.

Whether you're buying, building, investing or just exploring options, we start with a friendly, no-pressure conversation to understand your situation and what success looks like for you.

2. We Build a Game Plan

🧩 Tailored solutions that fit your goals, not just what the banks are pushing.

We’ll crunch the numbers, compare lenders, and map out the smartest strategy taking into account grants, equity, tax benefits, structure, and long-term outcomes.

3. Get Prepped & Approved

✅ We handle the paperwork, keep you updated, and push things through fast.

From application to approval, we make the process smooth, avoiding roadblocks and making sure everything lines up so you're in the best possible position.

4. Settle In & Grow

🎯 It doesn’t end at settlement, we stay with you for the long haul.

We check in regularly to make sure your loan still suits your life. Whether you're planning to renovate, invest or just want a better deal, we're always just a call away.

Ready to achieve your financial goals?

Lets have a quick chat and get you one step closer.

We’re here to answer all your commercial finance questions.

-

Commercial loans can be used for buying business premises, funding a development, purchasing commercial property, buying equipment or vehicles, or even for cash flow and business expansion. We tailor the loan to your business goals.

-

Commercial loans typically have shorter terms, different assessment criteria, and may require a larger deposit (often 20–30%). Interest rates and fees can also vary. We help you navigate these differences and negotiate on your behalf.

-

Yes. Many of our clients are self-employed or run small businesses. We know which lenders are flexible with documentation (low doc or alt doc) and how to present your finances in the best light.

-

Loan amounts depend on the type of property, your deposit or equity, rental income (if any), and your financial position. We'll give you a clear picture of your borrowing capacity upfront so you can shop with confidence.

-

You can finance retail shops, offices, warehouses, industrial units, mixed-use buildings, and even specialised assets like medical suites or childcare centres. We match your needs with the right lender and structure.

-

Typically, lenders require financial statements, tax returns, business activity statements (BAS), a business plan (if applicable), and details of the property or asset. We’ll guide you through what’s needed for your specific deal.

-

The key is knowing which lenders suit your situation and that’s where we come in. We compare options across the market, negotiate terms, and ensure you’re not overpaying on fees or interest.

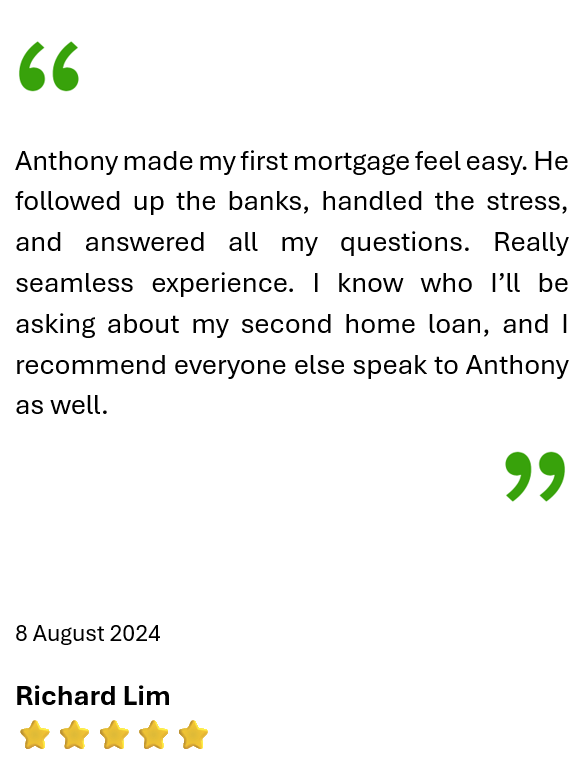

What Our Clients Say