Get on the road without the runaround

Secured and unsecured options

〰️

Secured and unsecured options 〰️

Finance that Moves with You.

Whether it’s for your growing family, a new job, or your business fleet. Securing the right vehicle finance shouldn't be a hassle. We’ll help you compare options beyond the dealer and avoid sneaky fees or over-inflated repayments.

Your Investment Game Plan

🚗 Personal or Business Use

We'll structure the loan around your needs whether it's a weekend SUV, your tradie ute, or a company vehicle.

💸 Competitive Rates & Terms

Skip the “easy” dealer finance that costs you more in the long run. We access a panel of lenders to find the sharpest deal.

📃 Fast Pre-Approval

Know what you can borrow before you start shopping. So you can negotiate like a cash buyer and move quickly.

⚖️ Balloon or No Balloon?

We'll walk you through flexible repayment options and explain how they impact your budget and future planning.

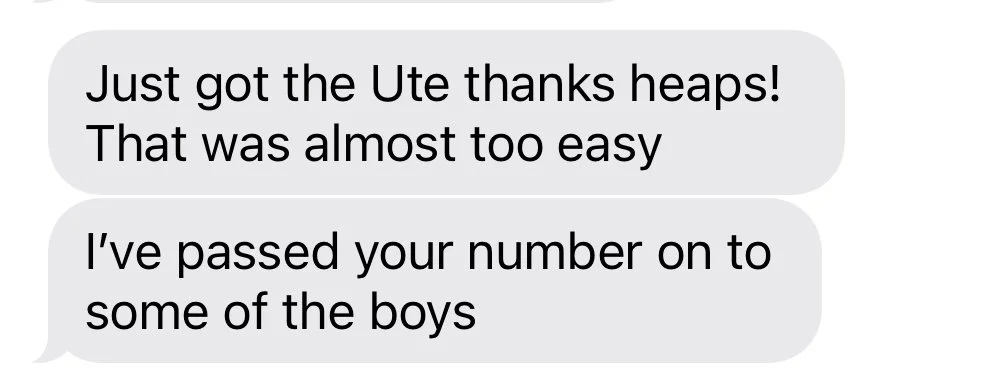

🚘 Vehicle Finance Wins.

Let’s make your next car purchase your easiest one yet.

Our most frequent financed ute

Client: Interior designer with a growing client base

Challenge: Wanted to upgrade from her hatchback to a luxury SUV to reflect her brand without blowing her budget

Solution: Structured a chattel mortgage with the car registered under her business. She got the car she wanted with tax-effective repayments.

Outcome: Picked up her Range Rover, made a statement at her next client pitch, and wrote off part of the vehicle for tax purposes.

Why it worked: By understanding how the business could benefit, we tailored the finance for lifestyle and financial efficiency.

Key Takeaways:

✅ Smart structuring = smarter tax outcomes

✅ Business vehicle finance that doesn’t feel ‘corporate’

✅ Flexibility between personal and business use

🚗 Family Ride, Smart Move

Client: Young family with 2 kids upgrading from a mid-size SUV

Challenge: Needed a safer, roomier car for weekend trips, daycare drop-offs and a growing boot full of sports gear. Wanted something nice but didn’t want to stretch too far.

Solution: We refinanced an existing personal loan to improve cash flow, then arranged competitive vehicle finance with flexible repayments.

Outcome: They picked up a Range Rover Sport with space, safety tech, and a touch of luxury—without compromising the household budget.

Why it worked: We structured the loan to suit their family’s lifestyle and financial comfort zone.

Key Takeaways:

✅ Upgrade your family car without overstretching

✅ Finance that fits around your life, not the other way around

✅ Keep the comfort and the cash flow

Need a new car or personal loan, we’ve got you covered. Get a quick quote

How It Works.

1. Let’s Chat

📞 Book a quick call so we can get to know you and your goals.

Whether you're buying, building, investing or just exploring options, we start with a friendly, no-pressure conversation to understand your situation and what success looks like for you.

2. We Build a Game Plan

🧩 Tailored solutions that fit your goals, not just what the banks are pushing.

We’ll crunch the numbers, compare lenders, and map out the smartest strategy taking into account grants, equity, tax benefits, structure, and long-term outcomes.

3. Get Prepped & Approved

✅ We handle the paperwork, keep you updated, and push things through fast.

From application to approval, we make the process smooth, avoiding roadblocks and making sure everything lines up so you're in the best possible position.

4. Settle In & Grow

🎯 It doesn’t end at settlement, we stay with you for the long haul.

We check in regularly to make sure your loan still suits your life. Whether you're planning to renovate, invest or just want a better deal, we're always just a call away.

Ready to achieve your financial goals?

Lets have a quick chat and get you one step closer.

Have questions about your next car purchase?

-

We can help you finance new or used cars, utes, vans, motorbikes, and even commercial vehicles. Whether it’s for personal use or for your business, we’ll find the right lender for your needs.

-

Not always. Some lenders offer 100% finance, which means no deposit needed. If you do have savings or a trade-in, we can structure the loan to reduce your repayments and interest costs.

-

A secured loan uses the car as collateral and usually comes with a lower interest rate. An unsecured loan doesn’t require the asset as security but often has a higher rate. We’ll explain what works best for your situation.

-

Yes. if you're self-employed or have a business, you may be eligible for chattel mortgages, leases, or low-doc options. These often come with tax benefits. We’ll make sure it’s set up properly with your accountant.

-

Vehicle finance is typically quick—approvals can happen within 24–48 hours. We’ll get all the documents sorted upfront so you can shop with confidence or negotiate like a cash buyer.

-

Lenders assess your income, credit history, employment stability, and any existing debts. We package your application to give you the strongest shot at approval and the best possible rate.

-

Yes. if you’re paying too much, we can help refinance your current loan to a lower rate or better structure. It’s also a great time to look at consolidating debts if needed.

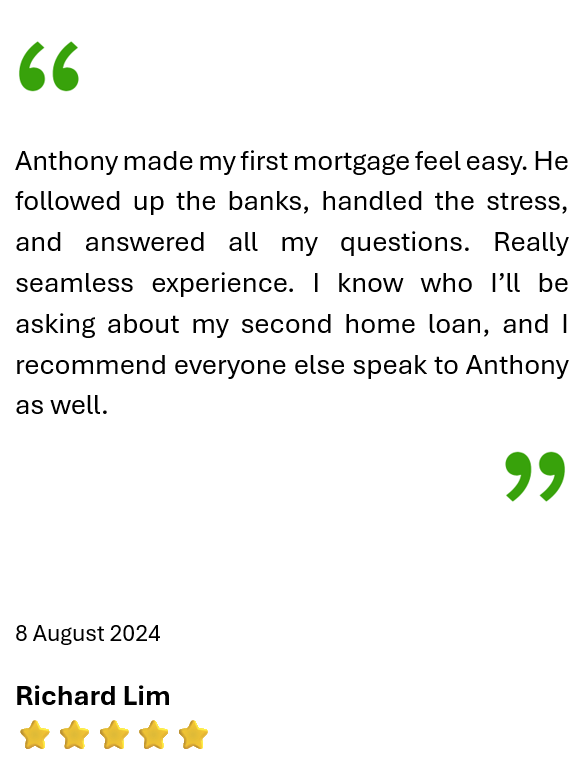

What Our Clients Say