Where Your

Home Ownership Journey Starts.

You don't need to wait until you have a 20% deposit

〰️

You don't need to wait until you have a 20% deposit 〰️

Your first home may be closer than you think.

Let’s start planning today.

Buying your first home is a major milestone. Exciting, but can often be overwhelming too. From saving for a deposit to understanding the process and competing with other buyers, there’s a lot to navigate. That’s where we come in.

At Mas Que Finance, we guide you every step of the way, answering your questions upfront so you can move forward with confidence. No surprises, just a smooth path to homeownership.

You may not know this already, there are many ways to get into the market without a 20% deposit. Some as low as 2-5% or possibly no deposit required.

The Process.

📊 Borrowing Power & Strategy.

We start by helping you understand what you can borrow, understand your goals and more importantly, what’s comfortable for your lifestyle.

💡 We don’t just crunch the numbers, we tailor a strategy that sets you up for success.

🎁 Grants, Schemes & Deposit.

We’ll check your eligibility for first home buyer grants, low deposit schemes and ways to get into the property market sooner so you may not have to wait.

💡 Some buyers think they need 20%. You might only need 5 or even zero cash upfront with a guarantor.

🏠 Pre-Approval & Property Search Support.

We’ll guide you through a rock-solid pre-approval so you can house hunt with confidence.

💡 We stay close while you search, providing property, suburb and upfront valuations to help your negotiation.

📝 Application to Settlement (and Beyond).

Once you’ve found “the one,” we handle the heavy lifting, from approval to settlement.

💡 Our goal isn’t just to get you the keys, it’s to be your go-to expert for life.

🎯 Client Wins.

🏡 Couple with Big Dreams & $35k

The Challenge:

A school teacher and a chef had saved $35k. They wanted to travel and plan their wedding, but were watching the prices rise in the areas they loved.What We Did:

Used the First Home Guarantee to get them in with less deposit

Found a townhouse 5 minutes from family

Structured the loan so they could keep savings for their big life events

Guided them from offer to keys and beyond.

Attended the wedding the year after.

The Result:

They got the home, married, travelled, and saw their property grow by $200k+ in 3 years.

Every family has a story and we’re proud to be part of theirs. Here’s how we’ve helped local first home buyers navigate the journey with confidence, clarity, and care.

🏖️ Self-Employed, 59-Year-Old First-Time Buyer

The Challenge:

A 59-year-old self-employed client earning above the $120k cap didn’t qualify for the First Home Guarantee. They had just 5% deposit and were stuck renting at the same cost as a mortgage.What We Did:

Used a guarantor loan to bypass LMI entirely

Found a lender who approved a 30-year term despite age

Secured stamp duty concessions to reduce upfront costs

Built a strong exit strategy to satisfy lender requirements

Enabled them to borrow 100%, keeping their deposit to buy furniture and put money back into their business.

The Result:

They secured their own place, avoided overextending, and maintained their savings. Mortgage = same as their rent

We win when you win. Let’s get you into your first home.

How It Works.

1. Let’s Chat

📞 Book a quick call so we can get to know you and your goals.

Whether you're buying, building, investing or just exploring options, we start with a friendly, no-pressure conversation to understand your situation and what success looks like for you.

2. We Build a Game Plan

🧩 Tailored solutions that fit your goals, not just what the banks are pushing.

We’ll crunch the numbers, compare lenders, and map out the smartest strategy taking into account grants, equity, tax benefits, structure, and long-term outcomes.

3. Get Prepped & Approved

✅ We handle the paperwork, keep you updated, and push things through fast.

From application to approval, we make the process smooth, avoiding roadblocks and making sure everything lines up so you're in the best possible position.

4. Settle In & Grow

🎯 It doesn’t end at settlement, we stay with you for the long haul.

We check in regularly to make sure your loan still suits your life. Whether you're planning to renovate, invest or just want a better deal, we're always just a call away.

Ready to achieve your financial goals?

Lets have a quick chat and get you one step closer.

We have helped our fair share of first home buyers. Here are our top FAQs

-

We look at your income, expenses, debts and credit history. Also how to strategically position your application to increase borrowing power.

It’s not just a number, it’s about what’s sustainable and smart for your goals. -

You might not need 20%. With the right lender or government scheme, you could get in with as little as:

5% deposit (First Home Guarantee)

0% deposit with a guarantor

105%+ using gifted funds or equity

We’ll explore every option to get you in the door sooner.

-

There are multiple options available:

First Home Guarantee (no LMI with 5% deposit)

Stamp Duty concessions or exemptions

Shared Equity schemes (depending on state)

We check your income, property price and situation to see what you qualify for — and help you apply.

Most people don’t realise what they’re eligible for until we walk them through it. -

It’s a government-backed program where you only need 5% deposit and avoid lenders mortgage insurance (LMI).

Places are limited, and only certain lenders offer it — but we’ve helped plenty of clients lock one in.

It’s a game-changer if you’ve got a small deposit and stable income. -

Yes — we can structure a Family Guarantee Loan where your parents use equity in their home instead of you needing a deposit.

We’ll guide you through how to protect their home and set up a clean exit plan.

A well-structured guarantor loan can save you years of renting or saving. -

Here’s a quick rundown, but we’ll provide an in depth funds position:

Stamp duty (we’ll help you minimise this)

Legal fees & conveyancing

Building & pest inspection

Lenders Mortgage Insurance (if applicable)

Loan setup costs

Moving costs, council rates, etc.

-

It usually takes 1–5 business days once we have your docs sorted.

Pre-approval typically lasts 3–6 months, and we can extend or refresh it if needed.

We can move as fast as you need and keep it valid while you shop.

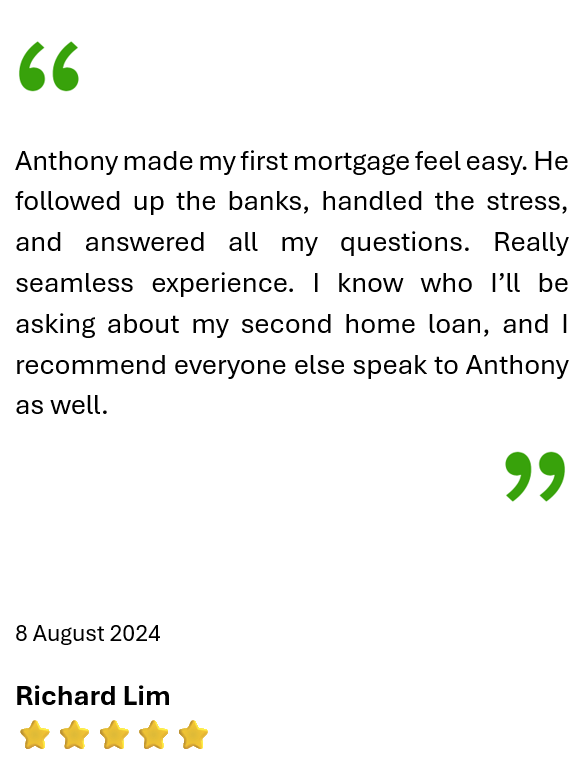

What Our Clients Say