Time for more space, a better location, or that forever home?

You don't always need to sell

〰️

You don't always need to sell 〰️

Time for a Home That Grows with You.

Your needs have changed—maybe your family’s grown, maybe your work-from-home setup needs a real office, or maybe you're ready for that backyard. Whether you're selling and buying, or keeping your current home as an investment, Mas Que Finance can map out the best way to upgrade without overextending yourself.

Plan Your Next Property Move.

🔁 Bridge the Gap.

Timing is everything. We’ll help you navigate bridging loans, conditional approvals, and how to juggle buying before you sell (or vice versa).

📊 Equity-Based Strategies.

Tap into your existing property’s value and structure your next loan smartly—without draining your savings.

👨👩👧👦 Family-Focused Finance.

We’ll ensure your next move matches your family’s changing needs—school zones, space, and lifestyle upgrades.

💼 Expert Negotiation Support.

We work with agents, conveyancers, and lenders to make your transition smooth, with fewer headaches and more clarity.

🏖️ From Sydney Stress to Coastal Dream Life

The Challenge:

A hardworking couple with two kids — both essential workers in transport — were ready to escape the Sydney grind. They owned two properties but needed a strategy to upgrade their lifestyle and secure a dream home by the beach.What We Did:

✅ Used a third-tier lender to stretch borrowing capacity and make the move happen

✅ Converted one property into an investment to hold long-term

✅ Timed the market to sell the investment at peak value two years later

✅ Refinanced to a major lender once equity improved for a better rate

✅ Moved into their dream home without overextendingThe Result:

They got into their ideal coastal location when it mattered, and two years later they’ve sold one investment and built serious equity in their current home. Now sitting under 30% LVR — and they’re only in their 40s.

Every family has a story and we’re proud to be part of theirs. Here’s how we’ve helped local first home buyers navigate the journey with confidence, clarity, and care.

🎯 Client Wins.

🏡 Upgrading Without Selling and Making Room for a Growing Family

The Challenge:

A young couple in their mid-30s with one child and another on the way. They loved their neighbourhood but had outgrown their two-bedroom home. They were hesitant to sell and worried they’d miss the market if they tried to buy and sell at the same time.What We Did:

✅ Used equity in their existing home to fund the deposit on their next

✅ Secured a bridging loan to allow a smooth transition without a rushed sale

✅ Guided them on timing the sale of their existing property for peak value

✅ Helped them navigate the process of buying first, selling later — without stress

✅ Prepped their finances for a smooth move and a strong long-term planThe Result:

They upgraded to a spacious family home nearby with time to prepare their old home for sale — no fire sale, no last-minute moving truck chaos. Their bridging loan was repaid within 6 weeks, and they were able to settle in before baby #2 arrived.

We win when you win. Let’s get you into your first home.

How It Works.

1. Let’s Chat

📞 Book a quick call so we can get to know you and your goals.

Whether you're buying, building, investing or just exploring options, we start with a friendly, no-pressure conversation to understand your situation and what success looks like for you.

2. We Build a Game Plan

🧩 Tailored solutions that fit your goals, not just what the banks are pushing.

We’ll crunch the numbers, compare lenders, and map out the smartest strategy taking into account grants, equity, tax benefits, structure, and long-term outcomes.

3. Get Prepped & Approved

✅ We handle the paperwork, keep you updated, and push things through fast.

From application to approval, we make the process smooth, avoiding roadblocks and making sure everything lines up so you're in the best possible position.

4. Settle In & Grow

🎯 It doesn’t end at settlement, we stay with you for the long haul.

We check in regularly to make sure your loan still suits your life. Whether you're planning to renovate, invest or just want a better deal, we're always just a call away.

Ready to achieve your financial goals?

Lets have a quick chat and get you one step closer.

We have helped our fair share of first home buyers. Here are our top FAQs

-

Yes, this is a common strategy. Depending on your equity and financial position, you may be eligible for a bridging loan or use existing equity to fund the purchase before selling.

We can assess your options and risk profile to make sure the move is smooth and stress-free.

-

It varies, but generally you’ll need at least 20% equity to avoid Lenders Mortgage Insurance (LMI). That said, we can explore options with lower equity and help you access accurate bank valuations to maximise your position.

-

While most government grants are targeted at first home buyers, some stamp duty concessions or family-focused schemes may still apply depending on your situation. We’ll walk you through what's available and how to qualify.

-

Possibly. If you're upgrading and want to borrow more or restructure your loan, refinancing is often the best approach.

We’ll compare lenders to ensure your new setup suits your lifestyle and goals.

-

We’ll help you assess how much more you can borrow based on your current repayments, income, and future goals without overstretching yourself. We’re all about sustainable lending with a plan.

-

Yes! If you’re thinking of turning your existing home into an investment property, we can help structure your loans to optimise tax efficiency, equity use, and borrowing capacity.

-

Timing can be tricky, but we’ve got strategies to help whether it's using bridging finance, flexible settlement dates, or simultaneous settlements. You won’t be left juggling chaos or caught without a roof over your head.

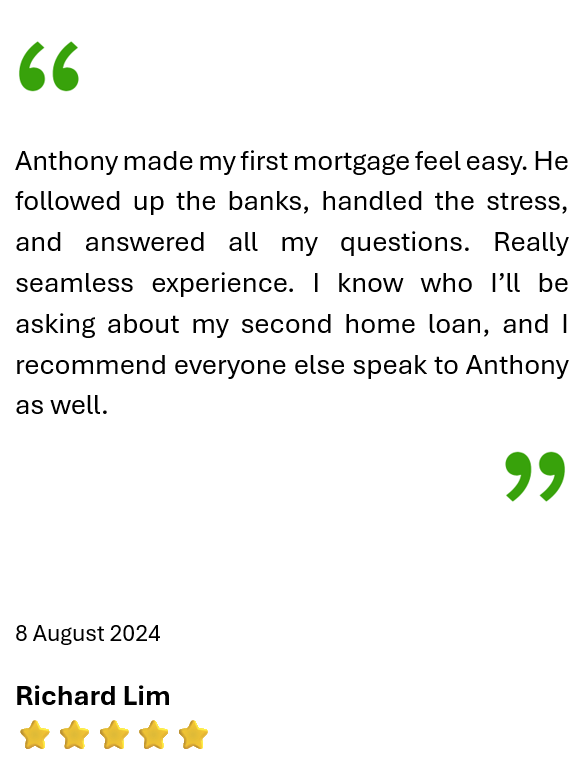

What Our Clients Say