Build wealth with smart property moves

Grow your wealth with property

〰️

Grow your wealth with property 〰️

Grow your portfolio with Confidence.

Property is one of Australia’s favourite wealth-building tools, but it takes more than just buying a second house. Whether you're a first-time investor or growing a portfolio, Mas Que Finance helps you structure the right finance, maximise your borrowing power, understand cash flow, and make sure you’re set up to scale.

Your Investment Game Plan

📊 Maximise Your Borrowing Capacity

We’ll work through lender options and strategies like interest-only loans, second-tier lenders with lower assessment buffers and lenders that suit your income type.

💼 Set Up the Right Structure

From personal names to trusts, or cross vs standalone loans. We explain the pros and cons so you can choose the right path for your goals.

🏠 Rent Ready Properties

We help you factor in rental yield, location, and how to present your profile to lenders in the best light.

🔁 Refinance to Scale

Already own property? We’ll unlock equity and refinance where needed, so you’re ready to make the next move when the right opportunity shows up.

A Legacy Built for the Next Generation

Client Profile

👨👩👧👦 Family of 5

🏡 Owned 2 properties, sold one to a developer

💰 $1M deposit available from the sale

The Challenge

Parents wanted to secure a future for each of their 3 kids

Needed a structure that allowed multiple investment properties

They were in their late 50s — had to move smart, not just fast

The Solution

✅ Used company/trust structures to maximise borrowing power

✅ Purchased 6 investment properties across different markets

✅ Structured loans for asset protection and succession planning

✅ Properties held separately from the family home

The Result

📈 Portfolio grew from $6M to $10.5M in under 9 years

🧱 Now each child will inherit 2 properties

🤝 Still loyal clients today — built on trust, planning, and purpose

Every family has a story and we’re proud to be part of theirs. Here’s how we’ve helped investors grow their property portfolio with confidence, clarity, and longevity.

🎯 Client Wins.

Slow, Smart, and Strong Growth

Client Profile

👤 Single male, 30 years old

👮♂️ Full-time PAYG worker (Police Officer)

💼 Started with a salary of $80,000

The Challenge

Wanted to start small but stay consistent

Avoid getting stuck at the common 2–3 property ceiling

Maintain lifestyle while building future cash flow

The Solution

✅ Focused on one property at a time, building equity slowly

✅ Smart lender choices to avoid capping out too early

✅ Reassessed and adjusted loan structures at each stage

✅ Balanced growth while still enjoying life and travel

The Result

🏘️ Now owns 5 investment properties by age 30

💵 Income has grown but remains in the same job he enjoys

🔮 Set up with strong future cash flow and freedom of choice

We win when you win. Let’s build a property portfolio your proud of that helps your goals.

How It Works.

1. Let’s Chat

📞 Book a quick call so we can get to know you and your goals.

Whether you're buying, building, investing or just exploring options, we start with a friendly, no-pressure conversation to understand your situation and what success looks like for you.

2. We Build a Game Plan

🧩 Tailored solutions that fit your goals, not just what the banks are pushing.

We’ll crunch the numbers, compare lenders, and map out the smartest strategy taking into account grants, equity, tax benefits, structure, and long-term outcomes.

3. Get Prepped & Approved

✅ We handle the paperwork, keep you updated, and push things through fast.

From application to approval, we make the process smooth, avoiding roadblocks and making sure everything lines up so you're in the best possible position.

4. Settle In & Grow

🎯 It doesn’t end at settlement, we stay with you for the long haul.

We check in regularly to make sure your loan still suits your life. Whether you're planning to renovate, invest or just want a better deal, we're always just a call away.

Ready to achieve your financial goals?

Lets have a quick chat and get you one step closer.

We’re here to answer all your investment questions.

-

Most lenders require a minimum 10% deposit for investment loans, but ideally, 20% helps you avoid Lenders Mortgage Insurance. You can also use equity from your existing property. Many investors start with none of their own cash.

-

Absolutely. This is one of the most common strategies. We can release usable equity to fund your investment deposit and costs, helping you grow your portfolio faster without needing to save a full deposit.

-

Principal & Interest (P&I) means you're paying down the loan balance. Interest-only lets you pay just the interest for a set period, which can maximise tax benefits and cash flow. We’ll help you decide what’s best based on your goals.

-

Rental income is added to your overall income when calculating borrowing power. Different lenders treat it differently. We know who’s investor-friendly and can help you maximise your capacity so they reduce the shading, don’t cap rental yield (like most at 6%) or include all the investment expenses on top of the shading. We’ve got you.

-

Beyond the deposit, there’s stamp duty, conveyancing, inspections, and potential landlord insurance. Plus, there’s the ongoing maintenance and property management fees. We help you plan and budget properly from day one.

-

Typically, yes. Investment loans often have slightly higher rates than owner-occupied ones. But with the right lender match and negotiation, we’ll keep your costs as low as possible.

-

This depends on your long-term goals, tax position, and asset protection needs. We’ll work alongside your accountant or recommend someone to ensure your structure supports both growth and security.

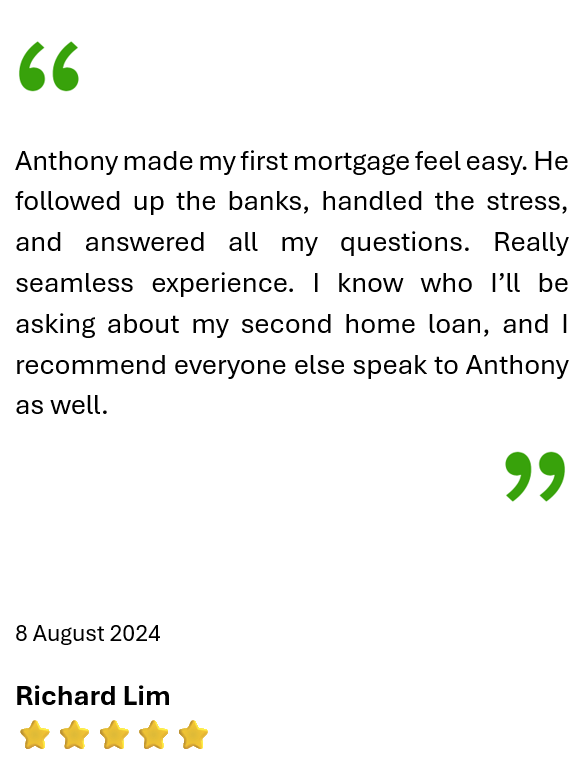

What Our Clients Say