Give Your Finances an EOFY Boost.

Fair Wealth is turning 80 We're giving back to essential workers like you.

$800 cashback* from us + up to $3,000 from select lenders.

You have two weeks to enquire

〰️

You have two weeks to enquire 〰️

Get more for yourself now

💰

Pair the $800 cashback with a lender cashback and your tax return and now you’ve got yourself a serious bonus this EOFY.

📈

Achieve you’re financial goals and discuss your plans with us. Buying your first home, investing upgrading, or need a holiday?

⏳

Your future self will thank you that you took action today instead of waiting. The cashback is only the start. It’s more about you and your goals.

Built for the Workers Who Keep Australia Running

I’ve Been Helping Essential Workers for Over 12 Years

From nurses doing night shifts, to train drivers who get everyone to work early. I’ve worked alongside essential workers like you for more than a decade.

You want someone who gets:

✔ The pressure of juggling family, shift work, and finances

✔ The importance of straight answers and zero fluff

✔ That your time is valuable and so is your trust

That’s why I built Mas Que Finance, it means “More Than Finance.”

Because it’s not just about the loan. It’s about helping you build a life you’re proud of, using the right strategy at the right time.

Who is this offer for?

🏡 First Home Buyers.

Think you need a huge deposit? Think again. We’ll guide you through government schemes and lender options that let you borrow 95%, 100%, even 105%. So you can stop renting sooner and start building your future.

📈 Family Upgraders.

Need more room or chasing that dream home? We’ll help you structure your next move smartly. Whether it’s bridging finance, unlocking equity, or just making sure you keep your repayments manageable.

💸 Refinance & Equity Release.

When was the last time you went equity hunting? Valuations can vary up to 30% between lenders. We run the numbers across multiple banks to help you access hidden equity for renovations, holidays, weddings, time off to start a family, business plans, or just better cash flow.

🏘️ Investors.

Ready to build wealth through property? We'll help you structure your loans for long-term growth, maximise your borrowing power, and avoid rookie mistakes that cost you in the long run.

🎯 Client Wins.

🏡 Couple with Big Dreams & $35k

The Challenge:

A school teacher and a chef had saved $35k. They wanted to travel and plan their wedding, but were watching the prices rise in the areas they loved.What We Did:

Used the First Home Guarantee to get them in with less deposit

Found a townhouse 5 minutes from family

Structured the loan so they could keep savings for their big life events

Guided them from offer to keys and beyond.

Attended the wedding the year after.

The Result:

They got the home, married, travelled, and saw their property grow by $200k+ in 3 years.

Every family has a story and we’re proud to be part of theirs. Here’s how we’ve helped local first home buyers navigate the journey with confidence, clarity, and care.

🏖️ Self-Employed, 59-Year-Old First-Time Buyer

The Challenge:

A 59-year-old self-employed client earning above the $120k cap didn’t qualify for the First Home Guarantee. They had just 5% deposit and were stuck renting at the same cost as a mortgage.What We Did:

Used a guarantor loan to bypass LMI entirely

Found a lender who approved a 30-year term despite age

Secured stamp duty concessions to reduce upfront costs

Built a strong exit strategy to satisfy lender requirements

Enabled them to borrow 100%, keeping their deposit to buy furniture and put money back into their business.

The Result:

They secured their own place, avoided overextending, and maintained their savings. Mortgage = same as their rent

🏖️ From Sydney Stress to Coastal Dream Life

The Challenge:

A hardworking couple with two kids — both essential workers in transport — were ready to escape the Sydney grind. They owned two properties but needed a strategy to upgrade their lifestyle and secure a dream home by the beach.What We Did:

✅ Used a third-tier lender to stretch borrowing capacity and make the move happen

✅ Converted one property into an investment to hold long-term

✅ Timed the market to sell the investment at peak value two years later

✅ Refinanced to a major lender once equity improved for a better rate

✅ Moved into their dream home without overextendingThe Result:

They got into their ideal coastal location when it mattered, and two years later they’ve sold one investment and built serious equity in their current home. Now sitting under 30% LVR — and they’re only in their 40s.

🏡 Upgrading Without Selling and Making Room for a Growing Family

The Challenge:

A young couple in their mid-30s with one child and another on the way. They loved their neighbourhood but had outgrown their two-bedroom home. They were hesitant to sell and worried they’d miss the market if they tried to buy and sell at the same time.What We Did:

✅ Used equity in their existing home to fund the deposit on their next

✅ Secured a bridging loan to allow a smooth transition without a rushed sale

✅ Guided them on timing the sale of their existing property for peak value

✅ Helped them navigate the process of buying first, selling later — without stress

✅ Prepped their finances for a smooth move and a strong long-term planThe Result:

They upgraded to a spacious family home nearby with time to prepare their old home for sale — no fire sale, no last-minute moving truck chaos. Their bridging loan was repaid within 6 weeks, and they were able to settle in before baby #2 arrived.

A Legacy Built for the Next Generation

Client Profile

👨👩👧👦 Family of 5

🏡 Owned 2 properties, sold one to a developer

💰 $1M deposit available from the sale

The Challenge

Parents wanted to secure a future for each of their 3 kids

Needed a structure that allowed multiple investment properties

They were in their late 50s — had to move smart, not just fast

The Solution

✅ Used company/trust structures to maximise borrowing power

✅ Purchased 6 investment properties across different markets

✅ Structured loans for asset protection and succession planning

✅ Properties held separately from the family home

The Result

📈 Portfolio grew from $6M to $10.5M in under 9 years

🧱 Now each child will inherit 2 properties

🤝 Still loyal clients today — built on trust, planning, and purpose

Slow, Smart, and Strong Growth

Client Profile

👤 Single male, 30 years old

👮♂️ Full-time PAYG worker (Police Officer)

💼 Started with a salary of $80,000

The Challenge

Wanted to start small but stay consistent

Avoid getting stuck at the common 2–3 property ceiling

Maintain lifestyle while building future cash flow

The Solution

✅ Focused on one property at a time, building equity slowly

✅ Smart lender choices to avoid capping out too early

✅ Reassessed and adjusted loan structures at each stage

✅ Balanced growth while still enjoying life and travel

The Result

🏘️ Now owns 5 investment properties by age 30

💵 Income has grown but remains in the same job he enjoys

🔮 Set up with strong future cash flow and freedom of choice

We win when you win. It’s less about us more about you.

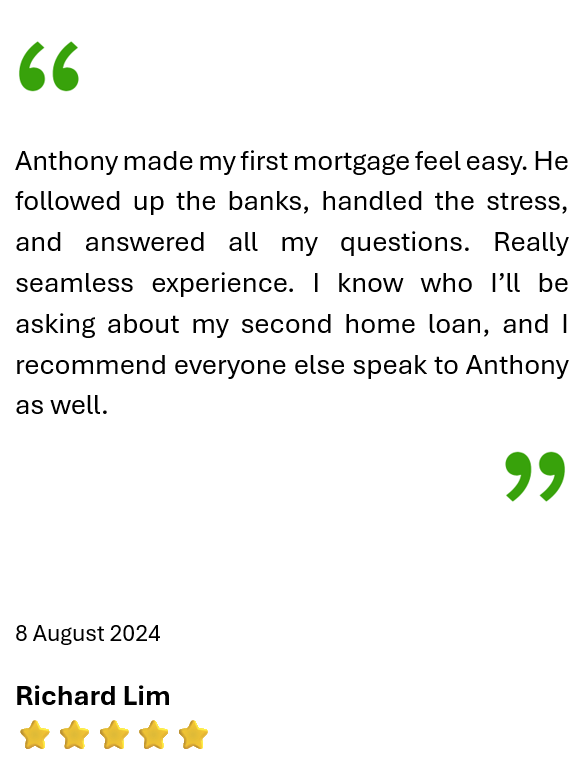

What Our Clients Say

About Anthony.

Your Mortgage Broker

Let’s chat & see if we’re a good fit

We’re a small team by choice. That means more one-on-one time, honest advice, and a long-term relationship, not just a one-off deal. If that sounds like what you’re after, let’s have a chat.

🎓 Background

With a Bachelor of Business & Commerce (Finance) and a Diploma in Mortgage Broking & Finance, I’ve spent the last 12 years in the finance industry, including 10 years as a mortgage broker. Over that time, I’ve built a reputation for delivering results. Even when things get tricky.

I’ve worked with first home buyers, growing families, business owners, and investors. Always with the same goal: making the process feel simple, smooth, and stress-free.

“My job is to take the weight off your shoulders and replace it with a clear plan.”

❤️ Why I do what I do

I’m not just a broker. I’m a dad, a husband, and someone who understands how big these decisions are for you and your family.

I started Mas Que Finance — Spanish for “More Than Finance” because that’s exactly what I believe this work is about. It’s not just about getting a loan. It’s about giving people the confidence to build the life they’ve been dreaming about.

🤝 What you can expect

✅ Straight-up advice no jargon, no pressure

✅ A clear, personalised plan tailored to your goals

✅ Strong lender relationships and sharp negotiating power

✅ Quick communication and total transparency

✅ A calm, guiding hand especially when things get stressful

👨👩👦 A little more about me

📍 Local South West Sydney

⚽ Massive Barcelona/Arsenal fan (yes, Mas Que Un Club inspired the name!)

👶 Proud dad to Hugo and Husband to Cassandra

🗣️ English & Spanish background

☕ A sucker for strong coffee and a good backyard BBQ

❤️ I underwent life-saving surgery that changed my perspective. It’s made me even more driven to remove stress from big financial decisions and help families focus on what really matters. The moments and goal, not the money.

P.S Cassandra and her family are from Madrid and are all Madridistas. El Clásico is extra interesting in our household

Get your Cashback offer today.

*The Mas Que Finance EOFY cashback offer applies to new home loan enquiries made before June 30, 2025:

$800 cashback for loans of $500,000 and above

$400 cashback for loans between $250,000 and $499,999

Loans must settle within 3 months of the initial enquiry date. Applies to purchases, refinances, and construction loans. One cashback per settled loan. This offer is provided by Mas Que Finance and is separate from any lender cashback promotions. $3,000 cashback offer from the lender is separate and based on lender conditions.